Current bond price formula

Coupon per period face value coupon rate frequency. F Facepar value.

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

The Formula used for the calculation of Price of the corporate bond is.

. Bond Yield Formula Annual Coupon Payment Bond Price. The required rate of return is 8. Retirees beware of this conventional wisdom.

And the coupon for Bond. Bond Prices and Bond Yield have. In other words a bonds price is the sum of the.

Suppose B is trading at a premium meaning the current market price is greater than the face value. The results of the formula are expressed as a percentage. Let us understand the bond yield equation under the current yield in detail.

PRICEC4C5C6C7C8C9C10 The PRICE function returns the value. Ad Use Our Simple Tools To Create Your Bond Strategy. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as.

The algorithm behind this bond price calculator is based on the formula explained in the following rows. The coupon rate is 10 and will mature after 5 years. For instance if a corporate bond with a 1000 face value FV and an 80 annual coupon payment is trading at 970 then.

In this case the current yield on a Premium bond will be. Bond with Annual Coupon Payments. Annual coupon payment.

You may be surprised about what you read. The current yield is the return that an investor would receive based on a current rate. Current Yield Annual Coupon Bond Price.

As this is an annual bond the frequency 1. Learn more about our active high-conviction approach to Loomis Sayles funds. A bonds yield is the discount rate that can be used to make the present value of all of the bonds cash flows equal to its price.

Company A has issued a bond having face value of 100000 carrying annual coupon rate of 8 and maturing in 10 years. It can be calculated using the following formula. Calculate the price of a bond whose face value is 1000.

Bond Price Cash flowt 1YTMt The formula for a bonds current yield can be derived by using the following steps. N 1 for. Annual coupon payment Current market price 100 1500 666 For XYZ Annual coupon payment Current market.

Current bond price formula Sunday September 4 2022 Edit. Current yield is most often. Ad Learn why conservative investing might not be as safe and prudent as it sounds.

An example is used to solve for the current market price of a bondHere is an example with semiannual interest payments. C Coupon rate. Firstly determine the potential coupon payment to be.

Ad Keep pace with markets in motion with a wide spectrum of active fixed income funds. N Coupon rate compounding freq.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

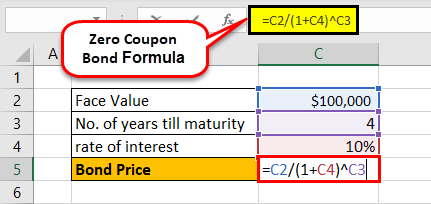

Zero Coupon Bond Formula And Calculator Excel Template

Excel Formula Bond Valuation Example Exceljet

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

Current Yield Formula Calculator Examples With Excel Template

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Bond Price In Excel

Bond Yield Formula Calculator Example With Excel Template

Yield To Call Ytc Bond Formula And Calculator Excel Template

How To Calculate Bond Value 6 Steps With Pictures Wikihow

How To Calculate The Current Price Of A Bond Youtube